Financial instability: Are you prepared? Despite the fact that ups and downs are unavoidable, many individuals are not. Before the pandemic, almost one-third of American families lacked the financial means to withstand the disruption of even a moderate financial shock.

To become so-called financially resilient, or to be able to weather a job loss, an economic downturn, or anything else that might affect your income or savings, preparation for the unforeseen is a crucial component. It’s okay to be wealthy to be a robust financial person. It’s about managing your funds wisely and proactively so that you can be more assured that they are set up now for whatever the future holds.

Why Is Financial Stability so Crucial?

Lockdowns, job losses, and the restructuring of entire industries caused by the COVID-19 epidemic have made us aware of how fragile people’s financial arrangements are. However, sometimes it happens that you have to turn to online loans no credit check instant approval canada 24/7 to improve your financial situation.

People who lost their employment and were unable to pay their payments for several months had additional stress as a result of having to borrow money from friends and family or build up credit card debt. Being resilient is essential for dealing with the unexpected. All of our lives altered quickly — sometimes dramatically — when COVID-19 struck Ontario and the closure was ordered. Those who had saved up and prepared ahead had one less stressor to deal with during a highly difficult period.

Have a Budget in Place

You must establish objectives in order to maintain your focus on what truly matters if you want to become financially robust. This aids in planning for situations that can disrupt your path to financial stability. One of the most important things you can do to increase your financial resilience is to have a rigorous strategy and stick to it. A plan is a well-thought-out, comprehensive blueprint for how you are going to make a difference, not just a resolve you make on the spur of the moment.

You must respond to questions such, as “What do I want to achieve?” to get started. What makes having a strategy crucial to me? What motivated my prior financial decisions?

Your financial plan is built on these responses, so once you have them, you can concentrate on drawing out your plan and figuring out how to reach your objective of financial resilience.

Set Up an Emergency Fund

If not for the unexpected, you may be saving money for a vacation or a new dog. Unexpected costs might not be able to be covered if you don’t have a financial cushion in place. The capacity to develop financial resilience is influenced by both the individual as well as the ecosystem in which they live and work. It is accomplished when a person or group is able to use the right resources, knowledge, confidence, and abilities to make wise financial decisions even during difficult financial circumstances.

It’s crucial to accumulate an emergency savings account so that you can bounce back as quickly as possible after a financial setback. It’s recommended to save three months’ worth of expenses aside for emergencies. You should strive to have enough money in your emergency fund to pay for three months’ worth of living expenses, such as rent or mortgage payments, food, and household bills, in the event that you lose your job unexpectedly.

Take Initiative

The two most crucial things someone can do to develop wealth and financial resilience are to understand their money and to begin saving while they are young. By beginning to save early in life, you may avoid the stress of having to catch up later in life and have more time to study money. Additionally, you will save more money the longer you invest.

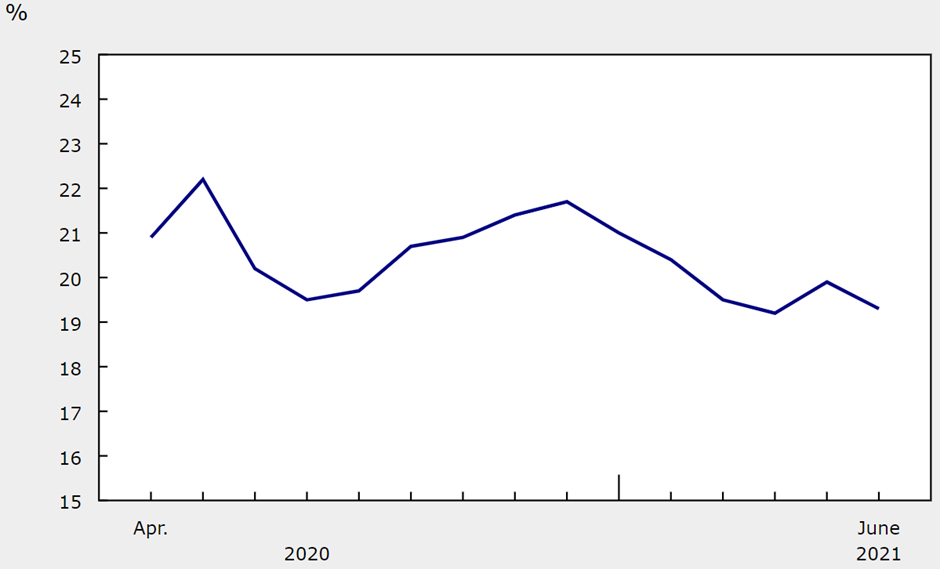

Families that the index classified as being financial “very susceptible” in June 2021 (16.5%) as opposed to immediately before the epidemic in February 2020 (23.3%), many households have improved their financial resilience during the duration of the pandemic.

Therefore, starting earlier and with a smaller sum offers a stronger base upon which to develop your wealth. It’s significant to highlight that misunderstandings exist over what is meant by the term “wealth”. Wealth is relative; it’s not a fixed amount; it depends on your aspirations and way of life. You can get wealthy if you invest and save. Even a tiny sum invested on a regular basis may have a big influence on your future.

Cut Back on Your Current Costs

Consider concentrating on methods to minimize costs and putting the excess money straight into your emergency savings to increase the size of your fund more quickly.

Identify three strategies to lower your present spending. Reducing the number of subscription plans you have, such as additional streaming services, finding a more affordable cell phone plan, being more deliberate with your spending to prioritize what you value, putting a 24-hour “wait” on all online impulse purchases before making a purchase, and saving your tax refund are some frequent examples (or reducing extra withholding that creates the tax refund).

Never Stop Learning

Your ability to manage your spending and saving might be strengthened by having a consistent income. Of course, there are many circumstances that might interrupt employment, but if you have transferrable, marketable talents, it will be simpler for you to obtain work if you lose your job. Determine the information you require to advance in your present position or change careers, and then get to work acquiring it.

Conclusion

The capacity to tolerate life events that have an influence on your income is referred to as financial resilience. This might be a fall in income, a job loss, or a significant increase in living expenses.

A mortgage on your home, a job loss, a divorce, or the expansion of your family are all significant life events that might lead to financial difficulties.

We can all take action to improve our financial resiliency. Our steps to assist create financial resilience are here to help with everything from boosting our capacity to make ends meet to creating and maintaining our savings goals.